Illustration by Jessica Turner.

THE YEAR OF COVID is to blame for historically low interest rates and an influx of buyers in East Dallas’ residential real estate market, says residential mortgage loan officer David Betbadal.

“It essentially turned into a mess for buyers,” Betbadal says. “The sellers were doing great because they’d list a home and there would be multiple offers, way over asking.”

The Willow Bend Mortgage loan officer attributes this to neighbors not wanting to move or let people into their homes. This led to a lack of supply on the market.

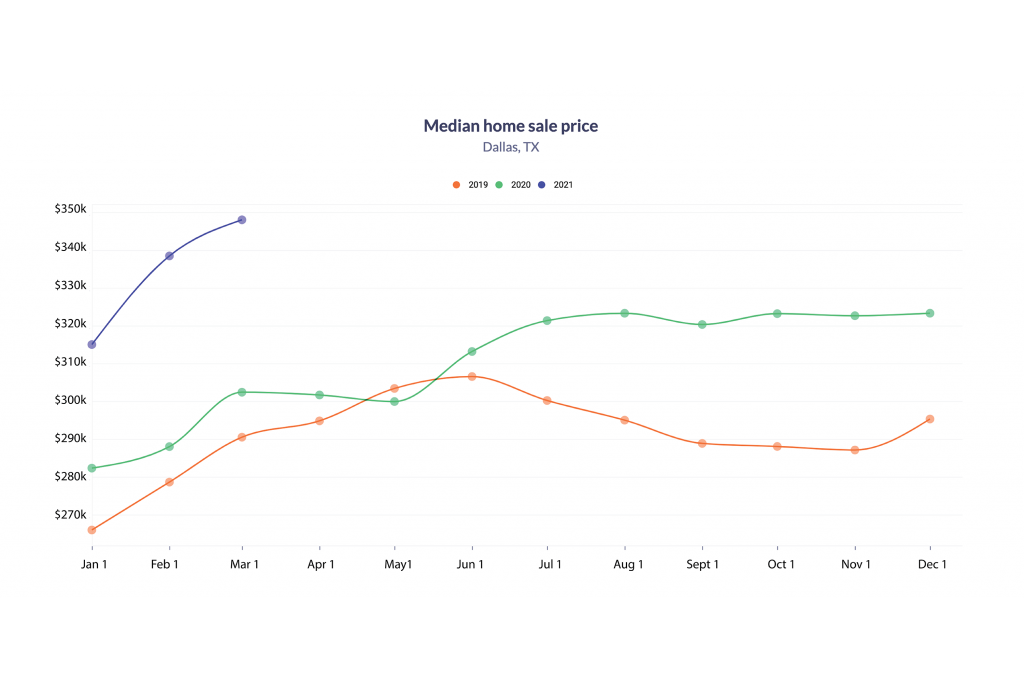

Dallas is now in a seller’s market, says Mason Whitehead, branch manager of Churchill Mortgage. That means it would take less than three months for all available homes in the area to be sold.

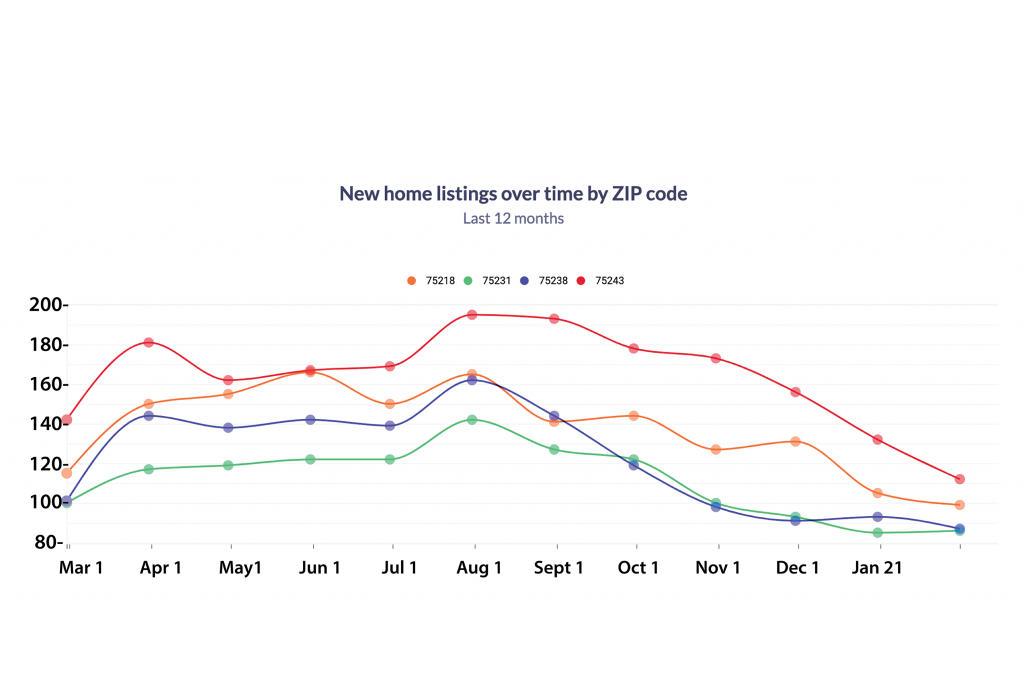

Graph by HiGeorge.

“What we’ve seen nationwide, but especially in Texas with the migration to Texas, is a huge housing boom like we’ve never seen before,” he says.

When buyers realized the game had gotten so extreme, Betbadal says they were more willing to bid higher on a home than they would have or accept less than they might have just to get into a home.

“It’s almost like house mania, if you will,” he says. “You just wanted to get in on something just so that you could.”

Another factor driving the demand for homes is an influx of people from other states, such as California and New York, who are looking for lower taxes and more space, says Whitehead, who’s been at Churchill for 11 years.

But that’s not the only reason.

“People know they can sell their house. That’s not an issue,” he says. “But where do you go? You’ve got a lot of pent-up hesitation because, I know I can sell, but where do I buy?”

As we slowly come out of COVID, Betbadal predicts homeowners will be more willing to move, which may result in more inventory.

“But it’s not necessarily going to solve all the problems,” he says. “It will be a little stream of homes. It won’t be the exact supply that’s needed, but it will hopefully help the situation.”

Like all markets, the pendulum will shift. Betbadal cannot predict the future, but as interest rates begin to rise and homes become more expensive as a result, the demand may be tempered.

“Maybe this is the beginning of normalization for the market,” he says.

Graph by HiGeorge.