Dallas is one of the top grocery markets in the country, crowded with competitors yet still a place where companies want to test their concepts, where the strong innovators survive and where the mediocre face extinction.

In recent years, we’ve seen Trader Joe’s enter the market and embark upon steady expansion. We’ve seen Aldi find its niches and succeed. We’ve seen Albertsons stores decrease and Tom Thumb stores increase after Albertsons merged with Tom Thumb parent company Safeway. We’ve seen Costco stake its claim. We’ve seen Walmart Neighborhood Market, Minyard Sun Fresh Market and The Fresh Market shutter.

And then, in just the last few months, we watched a whirlwind of activity as Tom Thumb took over the four Fresh Market spots, and H-E-B and Fiesta Mart purchased six and 11 of the Minyard closures, respectively, the former reinvigorating hopes that H-E-B’s titular store would finally find a home in Dallas.

Not so, as H-E-B announced plans for two additional Central Market stores in Preston Hollow and Uptown, likely to forestall any efforts by popular and savvy competitor Trader Joe’s in those areas; then sold one store to local developer Lincoln Property Company with plans to unload the other three as well.

Though this leaves a few sizable open spaces in and around our neighborhood — the former Albertsons-turned-Minyard Sun Fresh Market at Mockingbird and Abrams and also at Northwest Highway and Ferndale, and the Walmart on Greenville (on which Walmart is still paying rent) — the vacancies are remarkably low, says Bob Young, executive managing director of the newly rebranded Weitzman commercial real estate firm.

“When Fresh Market closed its four stores here last May, it only took eight months before Tom Thumb opened the doors again,” Young told real estate professionals gathered for a recent Weitzman 2017 Survey and Forecast event. “You know community centers are strong when vacant boxes are backfilled within months, not years.”

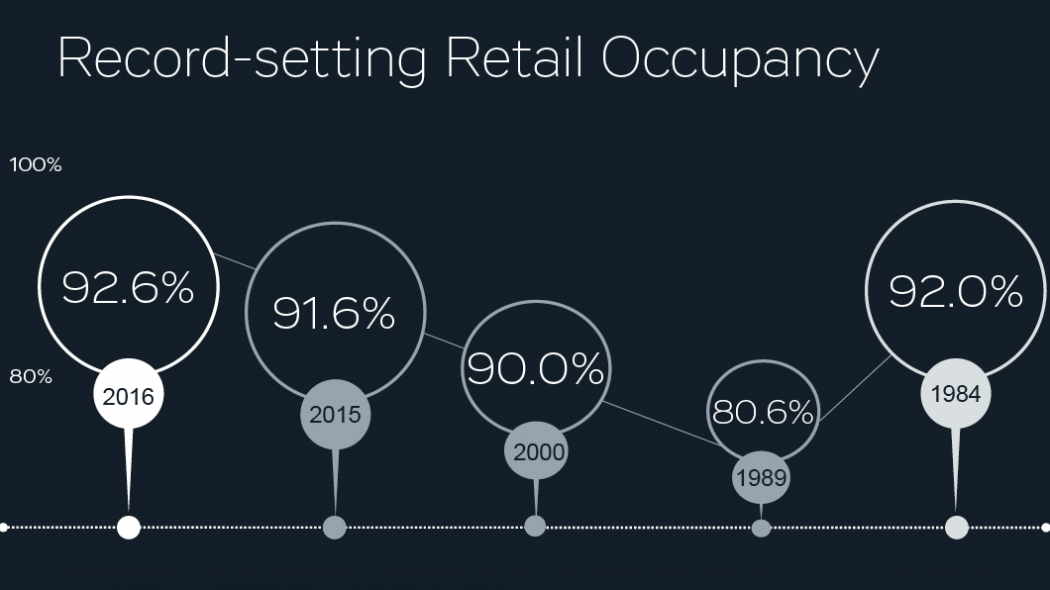

An image from Weitzman’s recent 2017 Survey and Forecast, showing retail occupancy rates between 1984 and 2017.

Young asserts that North Texas has “the strongest retail market in our history” with a record-high occupancy rate of 92.6 percent. This is the highest rate since 1984, he says, and the difference between now and then is “we are not overbuilding retail.”

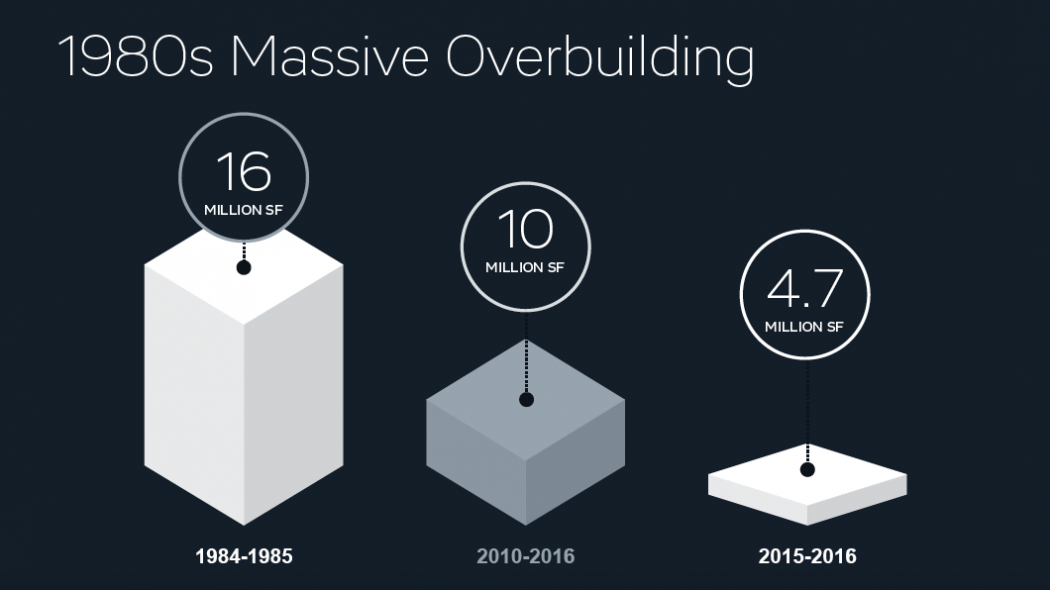

“Back then, this was the cycle: Boom. Build. Crash. Repeat,” Young says. “Now it’s: Grow and grow and grow, and then maybe, just maybe, consider a new retail center.”

Because the market was so hot in 1984, the real estate prospectors responded by adding nearly 16 million square feet of shopping space in only two years, Young says. In comparison, only 4.7 million square feet has been added in the past two years, and “if you took all new space added from Jan. 1, 2010, to Jan. 1, 2017, you’d still be 6 million square feet short of that 16 million square foot total for ’84-‘85,” he says. “And unlike today, a lot of that construction back then was spec.”

What we’re seeing today, he says, is renovations to existing retail spaces that are then being occupied by new businesses. This is often called “urban infill,” and Young says we will likely see more of it in 2017.

Shopping centers anchored by grocery stores, which Young defines as “community centers,” are among the top retail performers, he says, and a category where real estate professionals are seeing a demand for both existing space and new construction.

An image from Weitzman’s recent 2017 Survey and Forecast, showing retail construction between 1984 and 2017.

The few vacancies in our neighborhood may fill quickly, then, and proposed new construction is expected to introduce grocer anchors, too. Here are some likely tenants:

• Fiesta Mart: The Houston-based company emerged four decades ago to cater to Hispanic grocery shoppers and came under new ownership in April 2015. Since then, the company has been remodeling and expanding, most recently in DFW. Fiesta CEO Michael Byars says the company has embarked upon “a long-term reinvigoration,” and grocery experts are predicting that “ethnic grocery stores could be the next frontier for industry growth.”

All of this could result in new Fiesta stores in Lake Highlands or its vicinity, or offshoots of Fiesta, perhaps in addition to the several stores already operating. Fiesta is rumored to be the replacement for the two former Minyard Sun Fresh Markets at Mockingbird-Abrams and Northwest Highway-Ferndale, and we have a call into the company to find out more.

• Lidl: The European discount grocer often compared to Aldi has announced its expansion to the United States, and has named Texas as a target market. It will launch on the East Coast and make Texas its “second front,” notes Supermarket News.

Its site requirements, especially the “minimum 180 dedicated car parking spaces,” may not make it as versatile as Aldi, which has sought after urban infill locations in transitional areas. However, Lidl may be a good fit for new shopping centers, such as the proposed High Point shopping center on Northwest Highway-Abrams. Though Lidl has a low-cost model, it is is “a ‘little more cutting edge’ than Aldi, closer to a Trader Joe’s,” a Shelby Report story says, “with its affordable, higher-quality products and ‘interesting assortments’ that reinforce the foodie culture proposition.”

• Not a grocery store: Though community centers most often are anchored by grocers, Dallas is seeing some non-traditional anchors in urban infill spots. For example, Alamo Drafthouse is set to anchor the redeveloping Creekside Shopping Center at Skillman-Abrams, taking the place of grocer Tom Thumb and Simon David, which had anchored the center for decades. Young told us in a previous interview that “in retail real estate today, the most active, hottest kind of category is food and entertainment.”

Liquor superstores like Total Wine and Spec’s also are a possibility for vacant grocery spaces. Both concepts entered the Dallas market in recent years, opening in existing retail spaces, and Total Wine especially may be looking to gain a stronger foothold here, with only one store in Dallas proper.